Decades ago, your parents purchased a long-term care (LTC) policy. They have invested tens of thousands of dollars – or more – to give them the peace of mind that when and if they need it, the policy will cover the cost of their care. The policy has sat, untouched, for all this time and now your parents are ailing, and they are not sure how their policy works. It’s time to make some decisions about their future living situation.

This is a common scenario. And what most adult children of aging parents find is that LTC policies are complicated. No two policies are exactly the same. Even if your parents each purchased a policy from the same company, there could be slight differences to each. It also may be that they purchased their policies from different companies. It behooves all of you to dust off that policy(s) sooner rather than later and read the fine print. Here’s why:

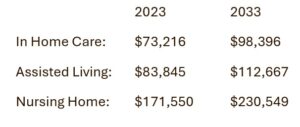

The Growing Cost of Care

Paying for long-term care on an extended basis is expensive. Here is a calculator provided by Genworth that shows the median annual cost of care in Pennsylvania in 2023 and how much it is expected to grow to in 10 years;

While these numbers may seem staggering, in our experience at Life Managers and Associates, the actual outlay we see with our clients is even higher.

Two Client Stories

Bill and Nancy:

We worked with Bill and Nancy who purchased an LTC policy decades ago, feeling confident that it would protect them financially when the time came. Now, Nancy who has her own health issues is the caretaker for Bill who has cognitive decline.

Bill and Nancy’s children, who live out of town, determine that their mother can no longer care for their father, but they know it is their parent’s wish to stay in their home. They move ahead with plans to hire a professional caretaker, believing that their parents’ LTC policy will cover the cost.

They reach out to the LTC insurance company only to find that their father’s level of cognitive decline does not yet qualify him for coverage. Their mother does not qualify because she is cognitively intact and can perform her own Activities of Daily Living (ADLs). What she can’t do is care for the father without jeopardizing her own health. The family is left with no other option but to pay for a caretaker out of pocket.

Jessica:

Another client, Jessica, who was also cognitively impaired, did qualify for coverage. Her children thought she would be cared for at home if needed. Imagine their shock, after 11 months of receiving benefits for a caretaker in Jessica’s home, to learn that their mother’s policy had a lifetime maximum for in-home care that would only cover 12 months. She did, however, have coverage if she were to move to a facility. The family now had to scramble to find somewhere for their mother to move to. Had they known this information at the outset, they would have had more time to look for a suitable facility.

LTC Policies Vary Significantly

To prevent these types of scenarios from happening to your family, it’s imperative that you understand the coverage provided by your parents’ LTC policy. That way, you know when to trigger it and what care options are available. Here are some conditions to understand:

- When can a claim be initiated

- What documentation is required to initiate a claim

- Who can speak to the insurance company about the policy

- What is the elimination period (the number of days that you must pay out of pocket before benefits commence)

- What are the daily and lifetime limits

- Are there restrictions on where the services can be given

- What services are covered – care management, respite care etc.

- Are premiums suspended when a claim is active

- What documentation is required for ongoing claims

Appoint a Designee to Understand the Benefits

We often see that when a senior finally needs LTC benefits, they are in a state where they either don’t realize that they now qualify to start receiving payments or they are incapable of filing a claim due to physical or mental restrictions.

To address this issue, it is important to designate a person who is familiar with the policy, understands the triggers, and knows how to submit a claim. This person also needs to be added as an authorized person to the account so that they can speak to the insurance agency about the policy. This designee will need to be involved on an ongoing basis to manage and navigate the claims processes.

We Can Help

It can seem daunting, with all the legalese and fine print, to know where to start when planning for your parents’ long-term care needs. The good news is that you don’t have to go it alone. As aging-in-place consultants, we can help you start a conversation with your parents to understand their wishes. We can review their policy to see if its benefits and coverage align with their goals. Then, we can help you and your parents develop a plan.

On an ongoing basis, we can serve as your eyes on site in your parents’ home, using our expertise in working with seniors to (1) identify when an insurance benefit is triggered and then (2) submit and manage the claims.

The key to successful aging-in-place always begins with advance planning. Before a situation arises, take the initiative to investigate your parents’ long term care policy. Armed with understanding, you can arrange to have the support in place to manage the benefits. You and your parents can have peace of mind that they are well-prepared for future care needs – allowing them to maintain their independence and safeguard their finances. Call us and let’s start the conversation.