When it comes to retirement and aging, many of us don’t think twice about planning for our golden years. It can be exciting to look ahead and prepare financially for that time and place to do what we’ve always wanted to do like traveling, taking up a new hobby, visiting grandchildren or even starting a second career.

Aside from the enjoyable aspects of life in retirement, we also have to plan for the harsh realities of getting older and what that might entail. We plan for the time of increased dependence on others also known as “incapacity,” which is defined as the physical or mental inability to manage one’s affairs.

Of course, this planning involves drawing up legal documents including power of attorney, advanced directives and purchasing long-term care insurance. We also plan for the end of life with a will, life insurance policies and trusts.

But what about the time in between these two stages?

The time between newly retired independence and being dependent on others is known as interdependence. It’s a period that is often overlooked. Most of us don’t plan for the interdependence stage but we should and here is why.

Benefits of Interdependence

This interdependent stage of aging is lasting longer because people are living longer with diminished capacity. It’s the time when individuals need some assistance with tasks but they’re still independent and able to live on their own. Most people want to stay in their home — in familiar surroundings and in their established community. Interdependence helps keep people in their homes longer.

And it’s important to realize that just because someone might lose regular function in performing tasks, doesn’t mean that individual can’t stay in their home and live independently.

For example, think about the act of snow shoveling. At some point, an individual might realize he or she shouldn’t shovel snow anymore because of a back problem or a heart issue or is simply afraid of falling. Just because that person shouldn’t shovel snow, doesn’t mean he or she stops being independent and is headed to an assisted living facility.

Instead, the person might consider getting help with snow shoveling, thereby extending his or her independence. That is exactly what interdependence is.

A more emotionally charged example is with daily money management. Unfortunately, research has shown that basic math is the first area to be affected by cognitive decline as people age. As the ability to comprehend math diminishes, money management becomes more challenging, sometimes resulting in checkbook mistakes or falling victim to money scams.

But similar to show shoveling, just because a certain task proves more challenging, doesn’t mean people can’t remain independent in their homes. They can be interdependent (and stay in their home longer) if they seek help with the necessary bill paying and checkbook balancing.

What’s more, two of the most common reasons aging adults leave their homes is because of the apparent risk of falls and medication errors. These two areas also have in-home solutions:

- Professionals can be brought in to reduce the risk of falls by identifying problem areas and remove clutter and area rugs, add grab bars and railings, as well as enhance lighting throughout the home.

- Aging individuals can also ask family or hire others to help them with sorting and distributing their daily medications to prevent harmful errors.

This interdependent period is crucial to recognize because it can also mean delaying or preventing the often, astronomical cost of home care and institutional care that can come with aging.

Identifying Trigger Points

If we neglect to plan for interdependence, it can often be too late to get help and accelerate a person’s need for costly care. Once people experience cognitive decline, it’s often too late to plan. This is because people are not always conscious of their own decline and that’s when life can get very complicated.

It’s before we reach the interdependence stage, that we need to plan and identify “trigger points” for relinquishing responsibilities.

Trigger points are completely personal and depend on the individual. Examples of trigger points might include planning to take a driver’s test annually and if that person fails, they know it’s time to stop driving. Or if they have more than a couple significant checkbook mistakes, knowing it’s time to ask someone else for help with money management.

Planning for interdependence is like an insurance policy for staying at home. It allows individuals to have more control over their future and their needs instead of a family member deciding what’s best for them..

Commonly Missed Planning Opportunity

Of course, it sounds like planning for interdependence makes sense on a personal and financial level. So why aren’t we proactively planning for this stage of aging?

The first reason is that it is relatively new. Many older adults today lack a frame of reference. They may have never witnessed their parents’ needing assistance. It’s likely that their parents did not live for years with chronic illness and diminished capacity.

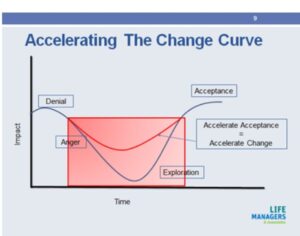

The second reason we are not proactively thinking and planning for interdependence is our inherent resistance to change. As Elisabeth Kübler-Ross illustrated in 1969 regarding how people deal with their own death, a “Change Curve” exists (see box). This curve can apply to any significant change, not just death, and includes four stages: denial, anger, exploration and acceptance.

For instance, on your commute to work on a busy thoroughfare, you notice a new sign stating that the road will be closed the following Monday. But when Monday comes, you forget to leave early to accommodate for the detour and experience denial. As you sit in the traffic of the detour, you become annoyed because it is taking too long and you are going to be late for a meeting so you feel anger.

The next day you might remember the detour but you are annoyed that leaving so early caused you to forget your morning coffee, and you’re still angry. It’s not until the third day that you find there is a Starbucks on the new route, which is the exploration stage. It’s at this point that you are on the upward trajectory of the curve. Once the road is back open, you decide to take the detour anyway so you can stop for your morning coffee and experience acceptance.

Any substantial change can take us through the Change Curve. Corporations have used this curve and realized that the bottom of the curve (the red box) is the “danger zone.” This is where the most money is lost. In response, companies employ change management experts with the goal of changing the slope of the curve. If change is managed well, the curve can be can be accelerated and money is saved.

The Change Curve to Increase Independence

But how does the Change Curve relate to aging and independence?

Denial is a leading reason that people don’t plan for loss of function or death. We tend to deny our (potential or current) changing abilities. It’s not until we explore how we can best live with limited abilities and then accept and ask for help that we are able to move in the upward slope (interdependence).

The longer we stay at the bottom of the curve in denial, the more dangerous and costlier it becomes for us. It is in this area of the curve that mistakes are more likely to happen, which may put us into the dependent stage prematurely.

For example, not recognizing one’s own physical deficits may mean a grab bar wasn’t installed to prevent a fall and as a result that individual might end up moving to an assisted living facility. Likewise, not accepting help with finances may lead to a devastating accounting error.

But recognizing and accepting potential deficits in daily functioning and knowing trigger points early is key to interdependent planning. When this happens, the Change Curve can be accelerated, keeping people in their home and money saved from having to move to a facility and all the costs that come with it.

In other words, knowing when to accept help (interdependence) from others early on is the way to extend independence. But most people need to understand interdependence options in order for it to benefit them.

Five Ways to Help Clients Plan for Interdependence

So how can you help your clients accelerate their Change Curve, become interdependent and stay in their homes?

- Explain Interdependence: Change is inevitable. Let your clients know the dangers of not planning for interdependence.

- Talk about Relinquishing Responsibility: Plant the seed at one meeting about what relinquishing responsibility (getting help) might look like but know that you will have to revisit it many more times.

- Have Them Create a Trigger Point Plan: Have your clients establish the “trigger points” for when they will know to relinquish responsibility for tasks and who will assume those responsibilities.

- Encourage Communication: Explain the value of discussing their interdependence plans with their families, friends or other supports.

- Use a Professional Service: When necessary and when family can’t be as readily available, it can make sense to call in professionals to help individuals carry out their interdependence plans.

Educating your clients on interdependence options early on can help them accelerate their own Change Curve into the acceptance stage of what might be ahead. This newly found awareness will help them confidently plan for the interdependent stage, identify their trigger points and do what most want to do: Stay in their homes as independently and as long as possible.

Life Mangers & Associates supports older individuals as a surrogate family member with the administrative and organizational responsibilities required to age in place. As a trusted member of their team, we help families feel safe and supported — alleviating stress for all.